Tokenization: Secure Your Transactions with Ease

09 Mar 25

09 Mar 25

Tokenization is a powerful method to protect sensitive information during transactions. It works by replacing credit card numbers and bank account details with unique tokens. These tokens have no value on their own, making them useless to hackers even if intercepted. This approach is especially crucial for secure payment processing.

Unlike encryption, tokenization is irreversible. While encryption converts data into a code that can be decoded, tokens cannot be reversed to retrieve the original information. This adds an extra layer of security. Payment gateways and digital vaults manage these tokens safely, ensuring your transactions remain protected.

Imagine making a purchase online without exposing your actual card details. That's what tokenization offers. It simplifies recurring payments and supports automatic updates for expired cards. This means uninterrupted service and less hassle for you.

The global tokenization market is growing rapidly, with major players adopting this technology to enhance security. By reducing the need to store sensitive data, tokenization also simplifies compliance with regulations like PCI-DSS. It's a smart way to stay ahead of fraud and keep your information safe.

Understanding Tokenization and Its Role in Data Security

Tokenization is a method that substitutes sensitive information with unique tokens, enhancing data security. This process is vital for protecting credit card details and other sensitive information during transactions.

What is Tokenization?

Tokenization replaces sensitive data, like credit card numbers, with tokens. For example, a card number like 1234-5678-9012-3456 becomes a token such as 6f7%gf38hfUa. This token has no intrinsic value, making it useless to hackers if intercepted.

Tokenization vs. Encryption: Key Differences

Unlike encryption, which can be decoded with a key, tokenization is irreversible. This makes it more secure for certain applications. Encryption converts data into code that can be deciphered, while tokens cannot be reversed to retrieve the original information.

| Feature | Tokenization | Encryption |

|---|---|---|

| Purpose | Replace sensitive data with tokens | Convert data into code |

| Reversibility | Irreversible | Reversible with key |

| Security | Higher for certain applications | Secure but reversible |

Tokenization reduces the risk of data breaches by substituting sensitive information with tokens, enhancing overall security.

How the Tokenization Process Works for Secure Payments

Secure payment processing relies on a method called tokenization to protect sensitive information. This process is designed to enhance data security during transactions, making it especially useful for credit card payments.

Step-by-Step Tokenization in Payment Processing

When you make a purchase, your credit card number is replaced with a unique token. For example, your card number 1234-4321-8765-5678 becomes a token like 6f7%gf38hfUa. This token is stored in a secure digital vault, ensuring your real information remains safe.

The Role of Payment Gateways and Secure Vaults

Payment gateways manage the tokenization process. They handle the substitution of your credit card number with a token and store it securely. During a transaction, the token is used instead of your real data, keeping your information isolated and secure. When the payment processor needs to verify the transaction, the token is mapped back to your actual card number through a secure system.

This method minimizes the risk of data breaches, as tokens have no value if intercepted. The system uses advanced algorithms to generate tokens, ensuring each one is unique and cannot be reversed. This makes tokenization a reliable choice for both online and in-person transactions, providing peace of mind for consumers and businesses alike.

Implementing Tokenization in Your Business Platform

Integrating tokenization into your business operations can significantly enhance data security and streamline transactions. This process not only protects sensitive information but also simplifies recurring payments and supports automatic updates for expired cards, ensuring uninterrupted service.

Preparing Your Systems for Tokenization Integration

To implement tokenization effectively, businesses must first prepare their systems. This involves conducting technical audits and compliance checks to ensure that sensitive data never enters the internal environment. By replacing credit card numbers with unique tokens, companies can reduce the risk of data breaches and maintain customer trust.

Choosing the Right Token Management Solutions

Selecting appropriate token management solutions is crucial for aligning with your business’s operational and security requirements. Key criteria include scalability, compliance with regulations like PCI-DSS, and the ability to integrate seamlessly with existing platforms. A robust token management system ensures that tokens are generated, stored, and mapped accurately, maintaining the integrity of your data.

| Feature | Tokenization | Encryption |

|---|---|---|

| Purpose | Replace sensitive data with tokens | Convert data into code |

| Reversibility | Irreversible | Reversible with key |

| Security | Higher for certain applications | Secure but reversible |

As highlighted in a recent study, businesses that adopt tokenization experience a significant reduction in data breach risks. “Tokenization is a game-changer for secure payment processing, offering unparalleled protection for sensitive information,” notes a leading cybersecurity expert.

By using established tokenization service providers, businesses can ensure seamless credit transaction processing. Ongoing management and oversight are essential to maintain token integrity and mapping accuracy, ensuring your systems remain secure and efficient. With the right approach, tokenization can be a powerful tool for enhancing your business’s data security and reducing exposure to breaches.

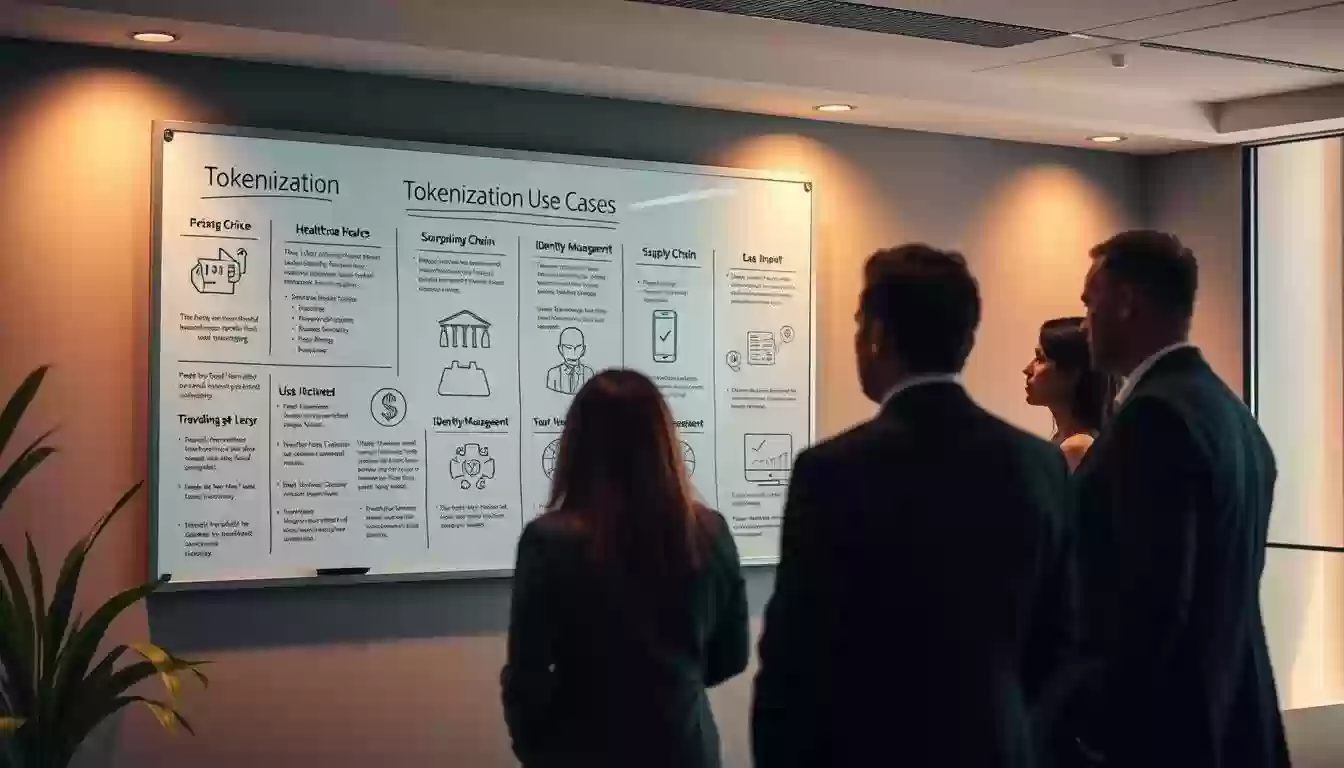

Exploring Real-World Use Cases for Tokenization

Tokenization is transforming how businesses handle secure transactions across various industries. From ecommerce platforms to brick-and-mortar stores, this technology offers practical solutions that enhance security and streamline payment processing. Let’s explore some real-world applications that highlight its benefits.

Ecommerce and Subscription Business Applications

In the ecommerce sector, tokenization plays a crucial role in protecting customer data. For example, platforms like Amazon and Netflix use tokens to secure recurring payments. When you subscribe to a service, your payment information is replaced with a unique token, ensuring your actual data remains safe. This approach reduces fraud and builds customer trust.

Brick-and-Mortar Retail and Multichannel Environments

Traditional retailers also benefit from tokenization. Point-of-sale systems in stores use tokens to safeguard payment data. For instance, when you swipe your card at a retail store, the system generates a token, preventing your real information from being exposed. This method is equally effective in multichannel environments, where businesses operate both online and offline.

| Industry | Benefits of Tokenization |

|---|---|

| Ecommerce | Secures recurring payments, reduces fraud, and enhances customer trust. |

| Brick-and-Mortar Retail | Protects payment data at POS systems, ensuring secure transactions. |

| Subscription Services | Streamlines recurring payments and supports automatic updates for expired cards. |

These examples demonstrate how tokenization adds value by safeguarding sensitive information. It not only improves security but also simplifies compliance and reduces the risk of data breaches. By adopting tokenization, organizations can build customer trust and ensure seamless payment processing across all platforms.

Best Practices for Managing Tokens and Sensitive Data

Maintaining the security and integrity of tokens is crucial for protecting sensitive information. Implementing best practices ensures that your systems remain compliant with industry standards while safeguarding against potential breaches.

Maintaining PCI DSS Compliance and Data Security Standards

One of the key aspects of token management is ensuring PCI DSS compliance. By minimizing the storage of sensitive data and using secure vaults, businesses can reduce the risk of breaches. Regular audits and strict access controls further enhance security, ensuring that only authorized personnel can handle tokens.

Encryption plays a vital role in protecting tokens. Using advanced algorithms and frequently updating security protocols helps maintain the integrity of sensitive information. Additionally, implementing access controls and monitoring systems allows businesses to quickly detect and respond to potential security breaches.

A robust management policy is essential for sustaining a secure environment. By following industry standards and real-world security protocols, businesses can ensure that their token management systems are both effective and compliant. Regular monitoring and audits help identify vulnerabilities, allowing for prompt action to mitigate risks.

Tokenization: Key Benefits and Value for Enterprises

For enterprises, adopting tokenization is more than just a security measure, it's a strategic move to enhance overall business value. By eliminating sensitive data from internal systems, tokenization not only reduces fraud but also streamlines operations, building trust and loyalty with customers.

Enhanced Security and Reduced Exposure to Breaches

Tokenization significantly reduces the risk of data breaches by replacing sensitive information with unique tokens. This method ensures that even if data is intercepted, it remains useless to hackers. According to a recent study, businesses using tokenization experience a substantial decrease in breach risks, making it a cornerstone of modern security strategies.

Simplified Data Management and Transaction Processing

Managing tokens is more efficient than handling raw data, leading to smoother transactions. For instance, recurring payments become easier as tokens can be reused, minimizing interruptions. This streamlined process not only saves time but also reduces the complexity of compliance with regulations like PCI-DSS, allowing businesses to focus on growth.

Building Customer Trust Through Secure Payments

Secure payment processing is vital for customer trust. Tokenization ensures that payment details are never exposed, creating a safer environment for transactions. As highlighted by Visa's issuance of over 10 billion tokens, this technology is proven to enhance trust, leading to higher customer satisfaction and loyalty.

In conclusion, tokenization offers enterprises enhanced security, streamlined operations, and stronger customer relationships. By adopting this technology, businesses can reduce fraud, improve efficiency, and build a trustworthy brand, positioning themselves for long-term success in a competitive market.

Conclusion

Tokenization has emerged as a cornerstone of modern data security, offering unmatched protection for sensitive information. By replacing valuable data with unique tokens, this technology transforms how businesses manage risk and secure transactions.

This approach not only reduces the risk of breaches but also simplifies compliance with regulations like PCI-DSS. Tokenization streamlines payment processing, supports recurring payments, and ensures uninterrupted service, making it indispensable for businesses and consumers alike.

Real-world applications span industries, from ecommerce platforms securing customer data to traditional retailers safeguarding point-of-sale transactions. Tokenization's versatility and effectiveness have made it a preferred solution for organizations seeking robust data security.

As technology evolves, tokenization continues to play a vital role in enhancing security and efficiency. Businesses are encouraged to adopt scalable tokenization solutions to future-proof their operations and maintain customer trust.

In conclusion, tokenization is more than a security measure, it's a strategic advantage. It empowers organizations to reduce risks, streamline processes, and build trust, ensuring they remain competitive in an ever-changing landscape.

FAQ

What is tokenization and how does it enhance data security?

Tokenization is a method that replaces sensitive information, like credit card numbers, with unique tokens. These tokens have no intrinsic value, making them useless to hackers. This process enhances security by ensuring your real data remains safe, even in the event of a breach.

How does the tokenization process work in payment systems?

When you make a transaction, your sensitive information is substituted with a token. This token is stored in a secure vault, while the actual data is protected. During processing, the token is used to reference the stored information, ensuring your details remain secure throughout the transaction.

What are the key benefits of using tokenization for businesses?

Tokenization reduces the risk of data breaches by protecting sensitive information. It also simplifies compliance with standards like PCI DSS, as less sensitive data is stored on your systems. Additionally, it builds customer trust by providing a secure payment environment.

How is tokenization different from encryption?

While both technologies protect data, they work differently. Encryption transforms data into a coded format that requires decryption. Tokenization replaces data with tokens that hold no value on their own. Tokenization is often preferred for its simplicity and enhanced security in transaction processing.

What industries can benefit the most from tokenization?

Any industry handling sensitive information, such as ecommerce, retail, and financial services, can benefit from tokenization. It is particularly valuable for businesses that process credit card transactions, manage user accounts, or handle personal customer data.

How can businesses implement tokenization into their systems?

Businesses can integrate tokenization by partnering with payment gateways that offer tokenization services. They should also ensure their systems are prepared to handle tokens and comply with data security standards. Choosing the right token management solutions is crucial for seamless implementation.

What are some common use cases for tokenization?

Common use cases include securing credit card transactions, protecting customer accounts, and managing sensitive user information. Tokenization is also used in subscription services and multichannel retail environments to ensure secure and seamless payments.

How does tokenization help with compliance and data security standards?

Tokenization reduces the scope of compliance by minimizing the amount of sensitive data stored on your systems. It helps businesses meet standards like PCI DSS and GDPR by ensuring sensitive information is protected and access is controlled.

Can tokenization be applied to data beyond credit card information?

Yes, tokenization can be applied to other sensitive data, such as personal identification numbers, addresses, and authentication credentials. It is a versatile solution for protecting any type of sensitive information.

How does tokenization impact the customer experience?

Tokenization enhances the customer experience by providing a secure and seamless payment process. Customers can feel confident that their information is protected, which builds trust and loyalty to your brand.