Unlocking the Secrets of Bitcoin: A Comprehensive Guide

10 Mar 25

10 Mar 25

Bitcoin, the world’s first decentralized digital currency, has revolutionized the way we think about money and financial transactions. Introduced in 2009, it operates on a peer-to-peer network, eliminating the need for central banks or intermediaries. This innovative system is secured by blockchain technology, which records transactions in a public ledger, ensuring transparency and security.

One of the key advantages of Bitcoin is its ability to give users full control over their finances. Without a central authority overseeing transactions, individuals can send and receive payments globally with minimal fees. This decentralized model has made Bitcoin a popular choice for those looking to support financial freedom and privacy.

As we delve into this guide, we’ll explore the core principles of Bitcoin, its evolution, and how it’s being used today. Whether you’re a beginner or already familiar with cryptocurrency, this guide will provide you with a clear understanding of Bitcoin’s role in the modern financial landscape.

Understanding Bitcoin: Its History and Evolution

Bitcoin's journey began with the mining of the genesis block in 2009, marking the birth of decentralized digital currency. This event laid the foundation for a peer-to-peer payment system that operates without central banks or intermediaries. Early adopters recognized its potential as a digital asset and cash alternative, leading to the first commercial transaction in 2010.

| Year | Event | Impact |

|---|---|---|

| 2008 | White Paper Release | Introduced Bitcoin's concept and design. |

| 2009 | Genesis Block | First block mined, launching Bitcoin. |

| 2010 | First Commercial Transaction | 10,000 BTC for two pizzas, proving real-world use. |

| 2013 | Price Surge | Reached $1,000, gaining market recognition. |

| 2017 | Regulatory Guidelines | Frameworks established, legitimizing Bitcoin. |

Regulatory milestones have significantly influenced Bitcoin's trajectory. Guidelines from FinCEN and global financial authorities have helped integrate Bitcoin into traditional systems. This evolution from an experimental cash alternative to a recognized digital asset underscores its growing legitimacy in the financial world.

Learn more about Bitcoin's regulatory journey and market shifts in our detailed guide: Bitcoin History and Evolution.

Exploring the Bitcoin Blockchain and Peer-to-Peer Network

The foundation of Bitcoin's operation lies in its blockchain technology and a peer-to-peer network. This decentralized system ensures that every transaction is secure and transparent, without relying on a central authority.

How the Blockchain Secures Digital Currency

The blockchain is a public ledger where each transaction is recorded in a block, connected via SHA-256 hashing. This creates an immutable chain, ensuring data integrity. Each block's transactions are validated through cryptographic processes, making it nearly impossible to alter past records.

Decentralization and the Role of Nodes

The network operates on open-source protocols, allowing developers worldwide to contribute and audit the code. Decentralized nodes maintain consensus, preventing fraudulent activities by validating transactions through complex algorithms. This distributed system eliminates a single point of failure, enhancing security and user control.

As cryptocurrency evolves, the blockchain's role in secure, efficient processing becomes increasingly vital. This technology not only supports digital currency but also opens possibilities for applications beyond finance, setting a significant trend in secure data management.

Navigating Bitcoin Transactions, Wallets, and Mining

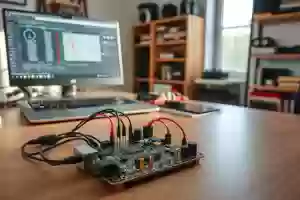

Understanding how Bitcoin transactions work is essential for anyone looking to engage with this digital currency. The process begins with a user creating a digital wallet, which can be software-based, hardware-based, or even a paper wallet for added security. These wallets generate unique addresses for each transaction, ensuring privacy and reducing the risk of fraudulent activities.

Processing Transactions and Ensuring Security

When a user initiates a transaction, it’s broadcast to the Bitcoin network for validation. Miners, using powerful hardware, solve complex mathematical problems to validate these transactions and add them to the blockchain. This process, known as proof-of-work, secures the network and ensures the integrity of each transaction. The miner who successfully adds a block to the blockchain is rewarded with newly minted Bitcoin and any associated transaction fees.

The Dynamics of Mining and Environmental Considerations

Mining plays a critical role in maintaining the Bitcoin network, but it also raises environmental concerns due to its high energy consumption. The process requires significant computational power, leading to increased carbon emissions. However, the Bitcoin community is exploring more sustainable practices to reduce its environmental impact while maintaining network security.

In summary, Bitcoin transactions are secure, transparent, and efficient, but the environmental challenges associated with mining remain a key area of focus. As the technology evolves, we can expect more innovative solutions to emerge, balancing security with sustainability.

Embracing bitcoin in Modern Finance

As digital money continues to reshape global economics, businesses and institutions are increasingly turning to crypto as a viable asset. This shift marks a significant evolution in how organizations view and utilize digital currency.

Crypto as a Digital Asset for Businesses

Companies like MicroStrategy and Belo have embraced crypto as a strategic reserve, leveraging it to hedge against inflation. This approach not only diversifies their holdings but also enhances liquidity. The integration of crypto into financial systems is further supported by developers who continuously refine transaction protocols, ensuring smoother and more secure processes.

Institutional Adoption and Investment Trends

Institutions are also making waves in the crypto space. Universities such as the University of Austin and Emory have invested millions in crypto funds, signaling a growing trust in digital assets. These investments are part of a broader trend where endowments and firms seek to balance risk and return in uncertain economic times.

While crypto offers promising opportunities, challenges like volatility and regulatory hurdles remain. Nonetheless, the forward-looking strategies of businesses and institutions highlight the potential for further integration of digital money into global economics.

Innovative Developments and Future Trends in Cryptocurrency

The cryptocurrency landscape is evolving rapidly, driven by advancements in technology and changing market dynamics. These innovations are reshaping how digital currencies function and are integrated into global finance. Let’s explore the key developments and future trends that are making waves in the crypto world.

Advancements in Open-Source Technology and Bitcoin Core

Recent updates to Bitcoin Core have enhanced both functionality and security. These improvements are the result of collaborative efforts in the open-source community, ensuring that the network remains robust and user-friendly. For instance, new wallet features now offer better account management tools, making it easier for users to manage their digital assets securely. Such updates highlight the importance of continuous development in maintaining the integrity and usability of cryptocurrency platforms.

The Impact of Global Market Movements and Regulation

Global market trends and regulatory changes significantly influence the trajectory of cryptocurrency. According to recent datum, the crypto market cap has surpassed $2.66 trillion, with Bitcoin showing a remarkable surge of 150% in 2024. These movements are further supported by regulatory clarity, which is helping to legitimize digital currencies. For example, industry reports indicate that clear guidelines are fostering greater institutional adoption and investment.

Emerging Use Cases and the Future of Digital Money

eyond traditional transactions, cryptocurrency is finding new applications in areas like decentralized finance (DeFi) and tokenized assets. These innovations are expanding the utility of digital money, making it more versatile and accessible. For example, the integration of AI with blockchain is enhancing trading strategies, while tokenization is increasing liquidity for traditionally illiquid assets. As these use cases grow, they pave the way for a future where digital currencies play a central role in the global economy.

Conclusion

As we conclude this guide, it's clear that the digital currency landscape is rapidly evolving, with Bitcoin at the forefront. Over the years, Bitcoin has transitioned from an experimental concept to a recognized digital asset, influencing both individual financial strategies and broader market dynamics.

Today, businesses and institutions are increasingly adopting Bitcoin as a strategic reserve, leveraging it to hedge against inflation and enhance liquidity. This shift underscores Bitcoin's growing legitimacy in modern finance. For individuals, the option to buy Bitcoin presents a unique investment opportunity, balancing potential returns with the practical benefits of decentralized financial services.

Looking ahead, the integration of digital money into global economics is expected to deepen. While regulatory challenges and market volatility remain, the resilience of Bitcoin's decentralized design and robust transaction processes continues to drive innovation. As the cryptocurrency landscape advances, staying informed will be key to navigating its evolving role in finance.

FAQ

What is the best way to get started with digital currency?

Start by setting up a secure wallet, choose a reputable exchange to buy your first coins, and educate yourself on blockchain basics to ensure safe transactions.

How do I ensure my transactions are secure?

Always use strong passwords, enable two-factor authentication, and verify the recipient's wallet address before sending funds to protect against fraud.

What are the advantages of peer-to-peer networks?

Peer-to-peer networks eliminate intermediaries, offering faster and more cost-effective transactions while promoting decentralization and financial inclusion.

Can I mine cryptocurrency on my own?

While possible, mining typically requires significant computational power. Joining a mining pool often yields better results for individual miners, though it's not necessary for using or investing in crypto.

How do I choose the right wallet for my needs?

Consider whether you need a hardware wallet for offline storage, a software wallet for convenience, or a paper wallet for minimal security, each with varying levels of accessibility and protection.

What factors influence the market trends of digital assets?

Market movements are affected by regulatory changes, adoption rates, technological advancements, and macroeconomic conditions, making it crucial to stay informed to make wise investment decisions.

How can businesses benefit from accepting digital payments?

Accepting crypto can reduce transaction fees, attract tech-savvy customers, and provide an edge in competitive markets by embracing this growing payment method.

What is the role of nodes in maintaining the network?

Nodes validate and relay transactions, ensuring the integrity and decentralization of the blockchain, which is vital for the network's security and operation.

How does the white paper influence the development of cryptocurrency?

The white paper outlines the project's vision and technology, guiding developers and attracting investors, serving as a foundational document for the crypto's ecosystem.

What are the environmental impacts of mining operations?

Mining consumes significant energy, prompting the industry to explore sustainable practices and renewable energy sources to mitigate its environmental footprint.

How can I stay updated on the latest developments in the crypto space?

Follow reputable sources, join online communities, and participate in forums to stay informed about technological advancements and market trends in the cryptocurrency world.