Bitcoin Solo Mining: Is It Still Profitable in 2025?

25 Feb 25

25 Feb 25

With the Bitcoin block reward dropping from 6.25 BTC to 3.125 BTC in 2024, many are questioning solo mining's future. Mining difficulty is expected to soar in 2025. It's key to look at costs, hardware, and price changes to see if solo mining is worth it. We'll compare solo mining to pool mining to guide your choice.

Bitcoin solo mining means one miner adds new blocks to the blockchain alone. It needs lots of power and energy. We'll check the costs and earnings to see if solo mining is better than joining a pool.

Introduction to Bitcoin Mining

Bitcoin mining is a complex process. It involves validating transactions and adding new blocks to the blockchain. This ensures transactions are secure and the same Bitcoin can't be spent twice.

The mining process rewards miners with mining rewards. As of early 2025, Foundry USA and Antpool control nearly 60% of the network's hashrate. This makes Bitcoin mining very competitive.

The average time to mine a new block is 10 minutes. The current reward for Bitcoin mining is 6.25 BTC. This reward halves every four years.

Miners do an average of 464 sextillion trial-and-error operations to find a hash with 20 leading zeroes. This makes solo mining hard and often unprofitable for individual miners. On the other hand, pool mining lets multiple miners share resources and rewards, making income more stable.

https://www.youtube.com/watch?v=wno5k5102Ig

In the next sections, we'll explore the differences between solo mining and pool mining. We'll also look at what makes Bitcoin mining profitable. We'll discuss the latest trends, including 3-nanometer ASIC chips and the importance of energy efficiency in mining.

The Basics of Bitcoin Mining

Bitcoin mining is a complex process. It involves validating Bitcoin transactions and adding them to the blockchain. This requires a lot of computational power and energy.

In return, miners get new Bitcoins and transaction fees. These rewards are the mining incentives. The mining process keeps the Bitcoin network secure and trustworthy.

How Bitcoin Transactions Work

Bitcoin transactions are checked through mining. This involves solving complex math problems. It needs a lot of computing power and energy.

This validation is key for the Bitcoin network's security and integrity.

Mining Rewards and Incentives

The mining rewards and mining incentives are vital for Bitcoin mining. The block reward for mining will drop from 6.25 BTC to 3.125 BTC in 2024. The blockchain is essential for this process, as it keeps all Bitcoin transactions safe and transparent.

The mining process is very competitive. The mining incentives are needed to keep miners motivated. They must continue to validate transactions and protect the network.

| Block Reward | Bitcoin Price | Mining Difficulty |

|---|---|---|

| 3.125 BTC | Variable | Adjusts every 2 weeks |

Understanding Bitcoin Solo Mining

Bitcoin solo mining lets individual miners work alone in validating transactions. This method can lead to higher transaction fees and a stronger network. Yet, solo miners face unpredictable earnings and rely on luck to find a block.

Requirements for Solo Mining

To start solo mining, you need a lot of computing power and energy. You'll need mining hardware like high-performance ASICs and special software. The cost of this gear can be very high, with top ASICs costing $5,000 to $10,000 or more.

Pros and Cons of Solo Mining

The benefits of solo mining include the chance for higher transaction fees and a more decentralized network. But, there are downsides like unpredictable earnings and the need for lots of computing power and energy. Whether to solo mine depends on your hash power, risk tolerance, and control desires.

https://www.youtube.com/watch?v=nhWJq_IfX8s&pp=ygUNI2FzdHJvbm9tcG9vbA%3D%3D

| Pros | Cons |

|---|---|

| Potential for higher transaction fees | Higher variance in earnings |

| More decentralized network | Need for significant computational power and energy consumption |

Pool Mining Explained

Pool mining is when many miners work together. They validate transactions and share the rewards. This way, miners get a steady income. By joining a pool, they can use their power together to solve hard math problems and earn rewards.

One big advantage of pool mining is getting regular payouts. Mining pools charge fees, like 1% to 3%. For example, F2Pool takes 4.80% for each block, while BTC.com takes 4.27%. The blockchain makes sure all transactions are safe and clear.

In a mining pool, miners use their power to solve math problems. The rewards are split based on how much they contributed. This makes it easier for miners to earn money, as they don't have to go it alone. Over 95% of Bitcoin's total hashrate comes from mining pools.

Bitcoin Mining Profitability in 2025

As we explore the world of cryptocurrency, Bitcoin mining profitability is a big topic. The state of Bitcoin mining changes due to many factors. These include market trends and the health of the cryptocurrency market.

Key Factors Influencing Profitability

The mining profitability factors are the cost of electricity, mining hardware efficiency, and the Bitcoin price trends. It's vital to keep up with market changes. This helps understand how they affect Bitcoin mining profitability.

Current Market Trends

The market trends show a big rise in mining difficulty. This makes it harder for miners to get rewards. Yet, the chance for cryptocurrency growth keeps miners interested in

By knowing what affects Bitcoin mining profitability and following market trends, miners can make smart choices. They can handle the complex world of cryptocurrency mining.

Solo Mining vs. Pool Mining: A Direct Comparison

When comparing solo mining vs pool mining, big differences show up. Mining costs, reward distribution, and network difficulty all play a part. Solo mining needs a lot of power and energy, making it more expensive.

Pool mining, on the other hand, lets miners share their power. This makes it easier to solve problems and mine blocks. It also lowers the network difficulty.

The way rewards are given out differs too. Solo miners might wait a long time for a reward. Pool mining, though, offers more regular payouts. This is because rewards are based on the pool's success.

Looking at mining costs, solo mining starts with a big investment. It can cost millions to have a chance to mine one Bitcoin block a month. Pool mining, though, is more affordable. It's better for those with less money.

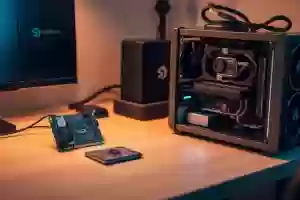

Equipment Needed for Solo Mining

Solo mining requires a lot of computational power and energy. You'll need high-performance mining equipment like ASICs and special software. We'll look at the top mining hardware and what makes them good.

Best Mining Hardware Options

There are many mining hardware options, each with its own specs and energy use. Here's a table comparing some of the best:

| Miner | Hashrate | Power Consumption | Efficiency |

|---|---|---|---|

| Bitmain Antminer S21 Pro | 234 TH/s | 3,510W | 15 J/TH |

| MicroBT Whatsminer M66S | 298 TH/s | 5,513W | 18 J/TH |

| Canaan Avalon A1566 | 150 TH/s | 3,225W | 21.5 J/TH |

Energy Consumption and Mining Costs

Mining costs, like energy use, are big in solo mining. To cut costs, use energy-saving mining gear and optimize your mining. The image below shows why energy use matters in solo mining.

The Risks of Solo Mining

Solo mining is risky, with profitability variability and equipment costs being major concerns. While solo mining can be very profitable, the cost of equipment and energy is high. For example, mining one Bitcoin block per month requires about 166,500 TH/s of hash power. This would cost millions of dollars upfront.

The solo mining risks grow as network difficulty increases and industrial-scale mining farms compete. This makes it harder to keep a solo mining operation profitable. Also, the cost of electricity for mining varies by region, sometimes exceeding mining rewards.

Before starting solo mining, it's important to think about these factors. Understanding equipment costs and

In summary, solo mining is both risky and potentially rewarding. It's important to consider profitability variability and equipment costs carefully. This way, miners can make smart choices and reduce their risks.

| Factor | Description |

|---|---|

| Profitability Variability | The chance of big changes in mining profits due to network difficulty and electricity costs. |

| Equipment Costs | The costs of buying and keeping mining gear, including hardware and energy use. |

| Potential Earnings | The money that can be made from solo mining, including block rewards and transaction fees. |

Future of Bitcoin Solo Mining

The future of Bitcoin solo mining is uncertain. Many factors will affect its success. As Bitcoin evolves, technological advancements in mining gear and software could change solo mining's profitability. The upcoming halving event will also impact the Bitcoin solo mining future and the cryptocurrency market.

One big challenge for solo miners is the rising mining difficulty. This means they need more powerful and efficient hardware to stay competitive. The cost of top-notch ASIC mining hardware, expected to be between $5,000 to $10,000 or more, is a big hurdle for individual miners. But, technological advancements in ASIC design and energy efficiency could lower costs and make solo mining more viable in the future.

As the cryptocurrency market grows, with a projected size of $94.19 billion by 2033, the need for efficient mining solutions will grow. Solo miners must adapt to these changes, using technological advancements and strategic partnerships to stay ahead. The future of Bitcoin solo mining will depend on miners' ability to innovate and evolve, ensuring its long-term viability in the cryptocurrency ecosystem.

| Factor | Impact on Solo Mining |

|---|---|

| Technological Advancements | Increased efficiency and reduced costs |

| Halving Event | Reduced block reward and increased competition |

| Mining Difficulty | Increased requirement for powerful hardware |

Conclusion: Making the Right Mining Choice

Choosing between solo mining and pool mining for Bitcoin in 2025 is complex. Solo mining could lead to bigger rewards, but it's risky and hard for most miners. The difficulty and resources needed are too high.

Joining a mining pool is safer and more reliable. It offers a steady income because everyone shares the work and rewards. With Bitcoin's block reward dropping to 3.125 BTC in 2024, miners will need to rely more on transaction fees to stay profitable.

Your mining choice depends on your situation. This includes your access to cheap electricity, the mining hardware you can buy, and how much risk you're willing to take. Those with cheap power and the latest ASIC technology will have an edge in 2025.

Whether solo mining or joining a pool, staying up-to-date with mining trends is key. By understanding the market and choosing wisely, you can succeed in Bitcoin mining.

FAQ

What is Bitcoin solo mining?

Bitcoin solo mining means one person mines Bitcoin alone. They add new blocks to the blockchain without help from others. It needs a lot of computer power and energy.

How does Bitcoin mining work?

Mining Bitcoin involves solving hard math problems. It needs lots of computer power and energy. Miners get new Bitcoins and fees for their work.

What are the requirements for solo mining Bitcoin?

Solo mining needs lots of computer power and energy. You'll need top-notch mining gear and special software to do it.

What are the advantages and disadvantages of solo mining Bitcoin?

Solo mining can be very rewarding but is expensive. It's risky, with unpredictable profits and high costs.

How does pool mining differ from solo mining?

Pool mining is when many miners work together. They share rewards and it's more stable, but profits are lower than solo mining.

What factors influence the profitability of Bitcoin mining in 2025?

Profitability depends on market trends, mining difficulty, and energy costs. These will shape Bitcoin mining profits in 2025.

What are the best mining hardware options for solo mining?

For solo mining, you need top mining gear and software. Choose based on energy use, power, and cost.

What are the predictions for the future of Bitcoin solo mining?

Bitcoin solo mining's future is uncertain. New tech could change its profitability, making it more or less viable.