Maximizing Bitcoin Mining Profits: Leveraging Real-Time Energy Markets

14 Nov 25

14 Nov 25

Understanding the New Frontier: Bitcoin Miners in Power Markets

Bitcoin mining has evolved far beyond its early days. Today, miners are increasingly sophisticated, operating in a landscape where efficient use of electricity determines long-term profitability. As energy costs remain a dominant factor in mining economics, forward-thinking miners are turning to real-time power markets to enhance their earnings.

The Structure of Electricity Markets

Power markets are becoming more dynamic, especially in the United States, thanks to deregulation and innovation. The wholesale electricity market consists of two primary segments: day-ahead and real-time markets. The day-ahead market operates 24 hours in advance, establishing prices based on projected supply and demand. In contrast, the real-time market functions on intervals as short as five minutes, allowing prices to respond to real-time changes in grid conditions.

Day-Ahead vs. Real-Time Markets

Day-ahead markets provide a predictable price structure for energy consumption, suitable for businesses seeking stability. Real-time markets, by contrast, offer a unique opportunity for those able to respond quickly to price swings—such as Bitcoin miners with flexible operations.

How Bitcoin Miners Engage With Power Markets

Traditional industrial operations typically favor long-term, fixed-rate electricity contracts. However, Bitcoin mining’s unique flexibility makes it suited for real-time market participation. By monitoring electricity prices throughout the day and adjusting operational intensity, miners can power up or curtail mining activity to align with the most favorable market conditions.

Technological advances enable miners to automate this decision-making process, maximizing revenue and minimizing costs.

Strategic Advantages for Miners

Unlike most industrial loads, Bitcoin mining can be rapidly scaled up or down. This flexibility allows miners to exploit periods of low or negative power prices, especially when excess renewable generation floods the grid. Conversely, miners can avoid operations when electricity costs spike, safeguarding margins.

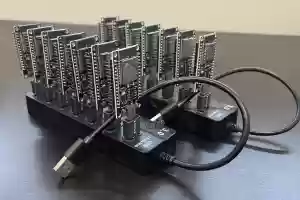

The Role of Automation and Intelligence

Modern mining operations integrate sophisticated software and hardware solutions to capitalize on real-time pricing. These systems analyze both Bitcoin network metrics (including price and difficulty) and current electricity rates. They can automatically power down machines when market conditions are unfavorable and ramp up when electricity becomes cheap, optimizing for maximal profitability.

Real-World Application: Automated Profit Maximization

For instance, a miner operating in Texas—a state with some of the world’s most volatile power markets—could program their operations to mine only when electricity costs less than a certain threshold, often determined by the current hashprice (a measure of USD earnings per terahash per second per day). This approach minimizes unnecessary losses and positions miners to benefit from periods of negative pricing, which occur when supply greatly exceeds demand.

Challenges and Risks in Real-Time Market Participation

While the potential rewards are significant, participating in real-time markets carries risks that miners must carefully manage. Price volatility can be intense, requiring robust forecasting and operational flexibility. Rapid market movements may force frequent changes in mining activity, which, over time, can affect equipment longevity and maintenance cycles.

Moreover, not all miners have direct access to these markets—often, they negotiate with retail energy providers or utilities who serve as intermediaries. Transparent agreements and responsive infrastructure are therefore vital to exploiting the benefits of real-time power pricing.

Texas: A Pioneering Example

Texas serves as a flagship for the integration of Bitcoin mining and dynamic electricity markets. The Electric Reliability Council of Texas (ERCOT) manages a fiercely competitive and largely deregulated grid, where prices are set every five minutes. Here, Bitcoin miners with advanced energy management systems have emerged as key grid participants, helping to balance supply and demand during both surpluses and shortages.

During times of excessive renewable energy production, such as windy nights or sunny afternoons, miners absorb excess power, preventing waste and stabilizing the grid. Conversely, during price spikes or grid stress, miners curtail operations, providing grid relief while optimizing their own profitability.

The Future: Grid Stability and Mining Symbiosis

As renewable energy penetration increases, grid operators require more flexible loads to maintain stability. Bitcoin miners—because they can instantly adjust their power usage—offer a solution. Their integration into real-time power markets benefits not only their bottom line but also the reliability and sustainability of the broader energy system.

Incentivizing Demand Response

Grid programs increasingly reward large users who can provide demand response—lowering or increasing power use at short notice. Bitcoin miners are uniquely suited for this role, and many are already leveraging these incentive programs alongside real-time market arbitrage to boost revenue streams.

Summary: Key Takeaways for Miners

- Real-time power markets provide an opportunity for flexible Bitcoin miners to boost profitability.

- Automated software solutions are essential for responding to rapidly changing electricity prices.

- Participating in dynamic markets can help miners lower power costs and benefit from negative pricing events.

- Engagement in power markets supports both mining economics and electrical grid stability.

- Strategic market participation is concentrated in deregulated regions such as Texas, with broad implications for the mining sector globally.

Conclusion

The evolving intersection of Bitcoin mining and real-time electricity markets signals a new era of operational sophistication in the crypto sector. Miners who master the art of power market participation—by dynamically adjusting their operations based on real-time price signals—stand to outpace competitors in both profitability and efficiency. As energy grids worldwide continue to modernize, these strategies will become ever more critical for those seeking sustainable mining operations in a high-stakes, fast-changing environment.