Solo vs Pool Bitcoin Mining in 2025 - A Simple, Numbers First Guide

22 Aug 25

22 Aug 25

Pool mining pays little but often. Solo mining pays nothing most of the time, but when you win a block you keep everything. Below we compare both paths with realistic 2025 numbers and a baseline electricity price of $0.15/kWh.

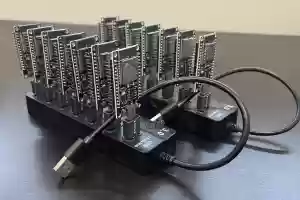

The two miners we’ll use

· Top-tier: Bitmain Antminer S21 Pro , ~234 TH/s, ~3510 W. Typical hardware price: $3.7k–$4.1k.

· Mid-tier: Bitmain Antminer T21 , ~190 TH/s, ~3610 W. Typical hardware price: lower than S21 Pro, but less efficient.

Baseline assumptions (kept simple)

· Block reward: 3.125 BTC (ignoring transaction fees for simplicity).

· Blocks per month: ~4,320.

· Network hashrate: ~960,000,000 TH/s (960 EH/s).

· BTC price for examples: $112,000 (illustrative).

· Electricity price: $0.15/kWh.

Pool (Shared) Mining - simple monthly snapshot

|

Top-tier S21 Pro (234 TH/s) |

Mid-tier T21 (190 TH/s) |

|

|

Expected BTC/month (before fees & power) |

~0.00329 BTC |

~0.00267 BTC |

|

Gross revenue @ $112k/BTC |

~$368.55 |

~$299.25 |

|

Power use (24/7) |

~2,527 kWh/month |

~2,599 kWh/month |

|

Electricity @ $0.15/kWh |

~$379.08/month |

~$389.88/month |

|

Pool fee (2%) |

~$7.37/month |

~$5.99/month |

|

Very rough net |

~−$17.90/month |

~−$96.62/month |

What this means: At $0.15/kWh, a single box is roughly break‑even to negative on pools (worse for the mid‑tier). Cheaper power or higher BTC helps; rising network hashrate hurts.

Pool mining - Pros & Cons

· Pros: Frequent small payouts (low variance), predictable cash flow, easy performance checks.

· Cons: Pool fees; reliance on third‑party payout schemes; thin margins at typical power prices.

Solo Mining - same machines, different payout shape

Your expected value before power is roughly similar to pool mining (math is math), but the distribution changes completely: long droughts, rare jackpots.

· Probability to find ≥1 block in a month - S21 Pro (234 TH/s): ~0.105% (~1 in 950 months on average; ~79 years).

· Probability - T21 (190 TH/s): ~0.085% (~1 in 1,170 months on average; ~97 years).

· If you hit: you keep the whole block (3.125 BTC). If not, you earn zero that period and still pay power.

Solo mining - Pros & Cons

· Pros: Full block reward when you win; maximum sovereignty; no pool fee.

· Cons: Extreme variance; very long dry spells are normal; ongoing electricity + hardware costs.

CapEx & payback (why many hesitate)

S21 Pro: ~$3.7k–$4.1k upfront. At $0.15/kWh, the pool scenario is close to break‑even or negative; solo has very long waits. Unless you have very cheap power or BTC rallies hard, ROI on a single machine can be slow and uncertain.

The obvious question: “Why make it so hard on yourself?”

Try FindTheBlock.com - an all‑inclusive Solo Mining package. Run true solo mining without buying hardware, without paying a home electricity bill, and without noise, heat, or maintenance headaches.

· No CapEx: skip the $3k–$4k hardware spend.

· No power bill at home: hosting & electricity are included.

· Dedicated solo power: hashing pointed to your address.

· Instant start: go live in minutes, not weeks.

· Monitoring & support: we keep rigs healthy; you focus on the win.

· Flexible packages: pick the hashrate/window that fits your budget.

· Simple pricing: one package cost, no surprise extras.

If you love the solo‑mining dream, owning the whole block when it hits, do it the smart way: keep the upside, drop the headaches.

Note: All figures are illustrative snapshots. Results change with BTC price, network hashrate/difficulty, fees, pool terms, uptime, and your actual power rate.