Harnessing Real-Time Power Markets: Maximizing Profitability in Bitcoin Mining

14 Nov 25

14 Nov 25

Introduction: The Intersection of Bitcoin Mining and Real-Time Power Markets

Bitcoin mining's profitability highly depends on operational efficiency and energy costs. As the industry matures, miners are exploring dynamic electricity markets to enhance returns and manage risks. Real-time power markets—where electricity prices adjust every five to fifteen minutes—offer agile miners unique opportunities to optimize operations and profitability.

Understanding Real-Time Power Markets

Traditional electricity pricing relies on long-term, fixed contracts, offering stability but limiting the ability to capitalize on short-term market fluctuations. Real-time power markets, in contrast, reflect immediate supply and demand and are characterized by rapidly changing prices. In these markets, energy costs can swing dramatically within short intervals, creating both risks and advantages for energy-intensive industries like Bitcoin mining.

Market Structure and Price Formation

Real-time power prices are determined by load forecasts, generation availability, weather events, and market participant bids. Grid operators, such as the Electric Reliability Council of Texas (ERCOT), update market clearing prices in 5- to 15-minute increments. Prices can dip below zero during surpluses or spike steeply during scarcity events.

Bitcoin Mining's Unique Flexibility

What separates Bitcoin mining from many other industrial loads is its inherent flexibility. Unlike manufacturing or data centers requiring constant uptime or set schedules, Bitcoin miners can rapidly reduce or increase their energy consumption with minimal operational disruption.

This load flexibility aligns well with the volatility of real-time power markets. By adjusting mining operations based on current or forecasted electricity prices, miners can curtail activity during price spikes and ramp up during low-cost periods, thereby protecting margins and even generating new revenue streams.

Strategies for Riding Power Market Waves

Pre-Curtailment Planning and Automation

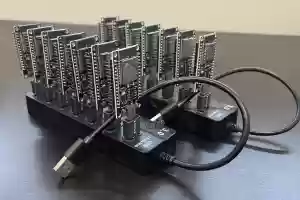

Proactive miners deploy software that monitors real-time price feeds and automatically powers down ASICs when electricity surpasses profitability thresholds—as low as five-minute intervals. These systems can reinstate operations as soon as favorable prices return, ensuring rapid response to market changes without manual intervention.

Revenue Optimization through Ancillary Services

Some market structures allow miners to participate in grid ancillary services—programs where businesses receive payments for committing to lower usage during scarcity events. By acting as a controllable load, miners access not only electricity savings but also new revenue streams, further cushioning operational economics.

Challenges and Considerations

Engaging directly with real-time markets requires advanced infrastructure, continuous monitoring, and risk management. Key considerations include:

- Operational Complexity: Dynamic schedules demand robust automation to keep mining hardware responsive and prevent unnecessary downtime.

- Market Risk: Extreme weather, regulatory changes, or grid constraints can introduce sudden price volatility, affecting both profitability and equipment longevity.

- Local Market Rules: Participation terms, settlement mechanisms, and ancillary services vary by grid region and operator. Understanding these specifics is essential for strategic planning.

Case Study: ERCOT and Flexible Mining in Texas

The ERCOT grid in Texas has emerged as a leading region for real-time market participation by Bitcoin miners. Due to its competitive structure and market transparency, miners in Texas have become instrumental in providing load flexibility during peak demand events—often shutting off or powering down equipment to help stabilize the grid while protecting themselves from excessive prices.

During grid emergencies or periods of negative pricing, these miners not only save on electricity costs but can also earn compensation for helping maintain overall system reliability.

The Future of Power Market Integration for Miners

As the Bitcoin mining sector grows more sophisticated and energy grids strive for stability amid increasing renewable penetration, the synergy between miners and real-time power markets is likely to strengthen. Automated demand response, integration with ancillary markets, and finely tuned price prediction algorithms are poised to become standard industry practice.

In the future, miners who can seamlessly adapt to both price signals and grid requirements will secure optimal profitability and play an active role in supporting energy infrastructure resilience.

Conclusion: Toward a Smarter, More Agile Mining Industry

Leveraging real-time power markets is rapidly becoming a key strategic advantage for Bitcoin miners facing tightening margins and operational uncertainty. Through flexible load management, automation, and active market participation, miners can transform volatility into opportunity—empowering not just their bottom line, but also contributing to a more responsive and sustainable power grid.