Riot Platforms Reports October 2023 Bitcoin Production and Operational Milestones

14 Nov 25

14 Nov 25

Riot Platforms Provides October 2023 Mining Update and Operations Overview

Riot Platforms, Inc., a prominent player in the Bitcoin mining industry, has released its operating results for October 2023. The update details key metrics in Bitcoin production, infrastructure expansion efforts, and the company’s ongoing strategic initiatives.

Key Operational Highlights for October 2023

During October, Riot Platforms mined a total of 458 Bitcoin, reflecting their substantial operational capacity at the company’s Rockdale site and advancing progress at their Corsicana facility. The company reported that it held approximately 7,350 Bitcoin at the end of the month, maintaining a robust digital asset reserve.

Bitcoin Production and Sales Activity

Mining Output and Inventory

Riot Platforms generated 458 Bitcoin in October. This continues the company's trend as one of the prominent North American Bitcoin miners. Compared to September, production figures were slightly lower due to both internal operational factors and ongoing construction.

Market Sales of Bitcoin

In line with its treasury management strategy, Riot sold 260 Bitcoin during the month, netting approximately $7.1 million in proceeds. The remaining 7,350 Bitcoin remain on the balance sheet, reflecting a deliberate reserve approach as the company evaluates market conditions and reinvestment opportunities.

Infrastructure Expansion and Facility Updates

Rockdale and Corsicana Deployment

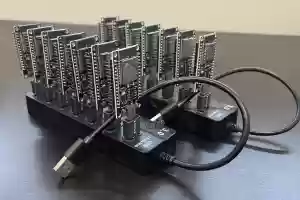

Rockdale, Riot’s primary mining site, maintained a deployed hash rate capacity of 10.7 exahash per second (EH/s). The company is also moving ahead with its Corsicana development in Navarro County, Texas. The first phase, encompassing 400 megawatts (MW) of capacity, continues to progress. Riot anticipates energizing 16,704 miners at Corsicana in the first quarter of 2024, which is poised to make a significant impact on future output.

Hash Rate Expansion Plans

Riot’s corporate strategy includes increasing its total self-mining hash rate. Upon the completion and energizing of the Corsicana facility’s initial phase, the company projects a hash rate surge to 20.2 EH/s. This aligns with Riot’s stated objectives of expanding its scale and operational footprint within the United States.

Strategic Power Management and Demand Response

One of Riot’s differentiators remains its strategic participation in power markets and responsive grid programs in Texas. During October, the company capitalized on revenue opportunities through both energy and ancillary services programs, offsetting operational costs and reinforcing its competitive positioning.

Operational Focus: Efficiency and Market Positioning

Mining Efficiency Initiatives

Riot continues to streamline its mining operations, reinforcing its commitment to efficiency. The company’s ongoing investments in state-of-the-art equipment, facility enhancements, and data analytics aim to optimize output while managing power consumption.

Industry Leadership and Growth Outlook

With its sizable Bitcoin holdings and planned capacity expansions, Riot underscores its intent to remain at the forefront of the U.S. Bitcoin mining landscape. As regulatory scrutiny and competition increase across the industry, Riot’s quarterly and monthly transparency signals a commitment to accountability and leadership.

Looking Ahead: Upcoming Milestones and Developments

Riot’s near-term focus remains on the Corsicana facility’s first-phase commissioning, which is expected to begin in early 2024. Once operational, the new site will boost Riot’s overall hash rate and further diversify its geographical and operational base.

The company’s management cites ongoing construction, preparation for energization, and potential Bitcoin market dynamics as factors likely to influence future updates. Riot’s next major operational disclosures will center on the progress at Corsicana and any strategic Bitcoin reserve management actions responding to market fluctuations.

About Riot Platforms

Riot Platforms, Inc. is a U.S.-based, publicly traded Bitcoin mining company focused on scaling digital infrastructure. With sites in Texas and a growing operational footprint, Riot combines renewable energy initiatives, cutting-edge technology, and large-scale mining operations to drive industry leadership. The company trades on NASDAQ under the ticker symbol RIOT.

Conclusion

Riot Platforms’ October 2023 update demonstrates its ongoing operational execution amid industry volatility. With a robust reserve of Bitcoin, strategic expansion plans, and a continued focus on power management and mining efficiency, the company positions itself as a leading force in the evolving Bitcoin mining sector. Stakeholders will be closely watching upcoming milestones, particularly the Corsicana energization, for further signals of Riot’s growth trajectory.